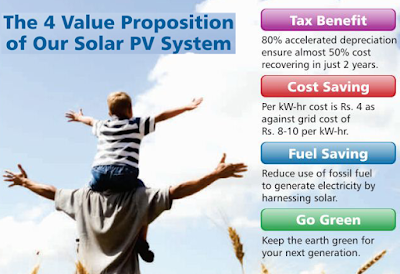

–Section 32 of IT act provides Accelerated Depreciation of 40 % + 40 % + 20 % of the invested capital to professionals companies with tax liability Lobel Investors can set off their tax liability on the taxable income to the tune of 40% in the 1st year, 40% 2nd year and subsequently 20% in the 2nd year

–Section 80-IA (sub section 4) of income tax Act, 1961 allows 100% tax waiver on the income generated for any single 10 year period during first 15 years of operational life of a power generation project. This is valid for projects commissioned till 31st March 2014

– Generation based incentives given by the government – Renewable Energy Certificates (REC) allows investors to gain a yield in the form of incentive currently being traded at average price of Rs 3.5 per unit of electricity generated by the solar power plant

– Third Party PPAs with reputed business houses and large industrial groups (which will be organized by Sai Saburi) allows per unit electricity to be sold at approximately Rs 6/KwH

– REC + PPAs results in per unit electricity selling rate of approximately Rs 9.5 per unit

– Lobel solar power plant (1MW) generation of 16,00,000 units in 1 year, revenue generation in 1 year will be around Rs 150 Lacs

– So, Break Even Point (BEP) of Lobel Investor is around 4 years, after which a long & stable income stream is established as solar power plants are deemed FIT & operational for a period of 25 years Solar plants can be commissioned by us in our

–Solar Park within a time frame of 3-6 months

– Registration with the Ministry of Environment & Forests allows participation in “Certified Emission Reduction” (CER) Credits in the international market (Carbon Credit)